Income Tax Calculator

Income Tax Calculator介绍

Latest: Income Tax Calculator for the financial year, FY 2020-21.

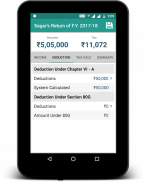

Income Tax Calculator is an app that helps you calculate the payable tax for the income you earned. Income tax slab is shown in the app for Individual Male, Female, Senior Citizen, and Super senior citizen. Tax preparation is very easy using this Income Tax calculation app. It provides you with free tax preparation help. You just need to enter all of your income and the deductions. The app will tell you the payable tax amount. Online Income Tax Return Filling will be so easy using this app. A taxable Income calculator app helps you keep a record summary, and you can share it via email or other social media applications.

Key Features of this app are:

» Quick Tax Calculation: The app provides the quickest way for tax computation.

» Compare Return: Select two different Assessment Year and compare your IT return for 2 years.

» IT Return:

You can plan your saving for the following income source:

√ Income from Salary

√ Income from Other Sources

√ Income from self-occupied house property

√ Long Term Capital Gains (LTCG)

√ Short Term Capital Gains (STCG)

√ Income from Interests

√ Income from Commissions

Income tax calculation formula will consider the following parameters for deductions while calculating IT Return:

√ Deduction under 80C (Investment in PPF, NSC, Life insurance Premium, etc.)

√ Deduction under 80D (Investment under Medical Insurance)

√ Deduction under 80DD (Investment for Medical treatment)

√ Deduction under 80EE (Interest on home loan for first-time homeowners)

√ Deduction under 80TTA (deduction to an individual or a Hindu undivided family in respect of interest received on deposits)

» Calculates Income Tax payable for Financial Year 2020-21, 2019-20, 2018-19, 2017-18, 2016-17, 2015-16.

» A standard deduction of Rs. 50,000 for salaried taxpayers for the Financial Year 2019-20 is updated.

» Find the tax payable with and without standard deduction of Rs. 50, 000 for the salaried taxpayers for the Financial Year 2020-21.

» Share It: The result in the form of PDF or image can be shared with family members or your Income Tax Consultant or Chartered Accountant.

--------------------------------------------------------------------------------------------------------------------------------

This App is developed at ASWDC by Sagar Makwana (140543107020), a 7th Sem CE Student. ASWDC is Apps, Software, and Website Development Center @ Darshan Institute of

Engineering & Technology, Rajkot run by Students & Staff of the Computer Engineering Department

Call us: +91-97277-47317

Write to us: aswdc@darshan.ac.in

Visit: http://www.aswdc.in http://www.darshan.ac.in

Follow us on Facebook: https://www.facebook.com/DarshanInstitute.Official

Follows us on Twitter: https://twitter.com/darshan_inst

最新:2020-21财年的所得税计算器。

所得税计算器是一款应用程序,可帮助您计算所得收入的应纳税额。应用中显示了针对男性,女性,老年人和超级老年人的所得税平板。使用此所得税计算应用程序,报税准备非常容易。它为您提供免费的报税帮助。您只需要输入所有收入和扣除额即可。该应用程序将告诉您应付税额。使用此应用程序,在线所得税申报表填写将非常容易。应税收入计算器应用程序可帮助您保留记录摘要,并且可以通过电子邮件或其他社交媒体应用程序共享它。

此应用的主要功能:

»快速税收计算:该应用程序提供了最快的税收计算方法。

»比较回报率:选择两个不同的评估年,并比较2年的IT回报率。

» IT退货:

您可以为以下收入来源计划储蓄:

√工资收入

√其他来源收入

√自住房屋财产收入

√长期资本收益(LTCG)

√短期资本收益(STCG)

√利息收入

√佣金收入

所得税计算公式将在计算IT报酬时考虑以下参数扣除额:

√在80C下扣除(购买PPF,NSC,人寿保险费等)

√在80D下扣除(医疗保险投资)

√根据80DD扣除(医疗投资)

√根据80EE扣除(首次购房者的房屋贷款利息)

√根据80TTA扣除(扣除个人或印度未成年家庭的存款利息)

»计算2020-21、2019-20、2018-19、2017-18、2016-17、2015-16财政年度的应付所得税。

»标准扣除Rs。已更新2019-20财年的50,000薪sal纳税人。

»查找有和没有标准扣除卢比的应付税款。 2020-21财年的薪,纳税人为50,000。

»共享:PDF或图像形式的结果可以与家庭成员或您的所得税顾问或特许会计师共享。

-------------------------------------------------- -------------------------------------------------- ----------------------------

此应用程序是由第七学期CE学生Sagar Makwana(140543107020)在ASWDC开发的。 ASWDC是Google达山学院的应用,软件和网站开发中心

工程与技术,Rajkot,由计算机工程系的学生和员工管理

致电我们:+ 91-97277-47317

写信给我们:aswdc@darshan.ac.in

造访:http://www.aswdc.in http://www.darshan.ac.in

在Facebook上关注我们:https://www.facebook.com/DarshanInstitute.Official

在Twitter上关注我们:https://twitter.com/darshan_inst